My big boss here at work (he of P365SAS fame) came into my office the other day and in a low voice asked me “Where can I sell some gold and silver?”

Well……

The Metals Pimp is somewhat semi-retired so I gave my boss the card for my buddy at the local coin shop. How much are we talking about, I asked, trying not sound terribly nosey. “Somewhere around $75,000 to $100,000”, he replied. That’s not a lightweight amount, but it’s not earth-shaking either. But there’s an opportunity in there.

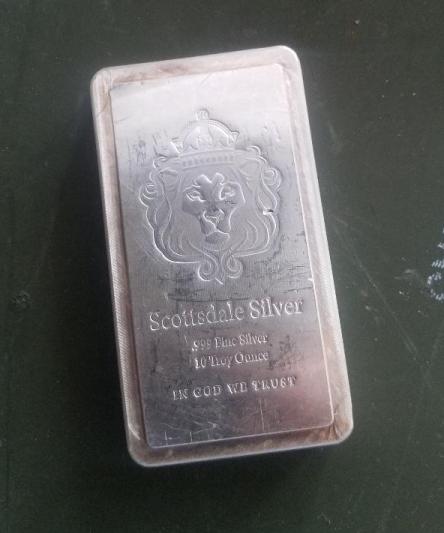

Whenever you buy PM’s (precious metals) there’s a ‘premium’. The premium is what you pay on top of ‘spot’ price. Spot is what the markets say current price is. For example: Gold is $2500/oz. so my guy is selling 1 oz. at “$100 over spot”. This means he’s selling it for spot price ($2500) plus another $100. Thus, your one ounce of gold will cost you $2600.

Now, what if you want to buy a smaller amount of gold? Maybe just a 1/10 oz? Interestingly, the premiums are higher the smaller the piece of gold. For example, a 1/10th oz. gold Eagle may be “10% over spot”. Well 1/10th of $2500 is $250 (because you’re not buying an ounce…your buying 1/10th of an ounce), and 10% of $250 is $25. So that 1/10th Eagle is, to you, $275.

Obviously the best thing you can hope for is to buy gold at spot, or even below spot. How do you buy gold at spot, you ask? Easy(ish): if the dealer buys it below spot, he can sell it at spot (or slightly above) and still make his money. The difference between what the dealer paid for it and what he sells it for is the spread….thats his profit. Gold is $2500/oz. He buys an Eagle over the counter for, say, “$20 below spot” and he sells it for “$25 over spot”…his profit is $45. Thats how this works.

Why would anyone sell their gold at below spot? For the same reason anyone sells anything – they want /need the money. But, also, some forms of gold are more desirable than others. If you walk into a coin shop with, say, some 1/10 Eagles or 1/4 oz. gold you’ll probably get a better price than if you walked in with a 10 oz. bar of gold. Why is that? Well, among other things, risk. It’s a lot easier for our guy to sell a 1/10th Eagle or similar small gold unit than it is to sell a 10 oz. bar. And every day he has to hold onto that 10 oz. bar is another day of risking a swing in the market. So, the bigger gold doesn’t get you as much when you sell it as the smaller gold does.

Usually what happens is when the dealer takes in a large quantity of gold, say a tube of 20 gold Eagles (thats $50,000 at current pricing), he just immediately calls a wholesaler and sells it to them that day so he doesnt get caught with it if the price craps the bed the next day.

So, if you want a good deal (gold at spot with no premium) you have to be willing to take gold in a form you may not ideally want. I told my guy that if he ever gets any gold in that he wants to sell at spot, let me know. And, once in a while, that happens. He’ll take in something that is in a form that makes it unlikely to sell quickly (foreign coin, commemorative, odd metric weight, etc.) so he just wants to get it sold and take his profit. Thats where I step in. I just want the gold…I dont care if its a French Rooster, British Sovereign, or Credit Suisse bar. In fact, I just got three British Sovereigns the other day at spot.

So, anyway, I called my guy and said that I was sending him someone that might have a bunch of gold he wants to unload. He said that if it worked out, he could give me a bit of a finders fee. I countered and told him that this was what I wanted as my finders fee: I get the opportunity to buy up to two ounces of gold at his price. I know he’s not going to pay more than spot, so I’m hoping there’s some fractionals (1/10, 1/4, 1/2, etc) in there. If I could get 20 1/10ths at spot I’d be supermegahappy.

Why don’t I just buy them straight from my boss, you might ask. I don’t want to create the awkwardness of hemming and hawing a deal out with the guy who signs my paycheck. Let the other guy do that and then just buy from him.

So, I’m hoping that when my boss returns from his trip next week he’ll have a nice stash of metals to take to my buddy and that I’ll wind up getting some good stuff at cost. I mean, I can live with two 1oz. Krugs at spot, but I’d much much rather have 20 1/10th Eagles at spot.

We shall see.

It was a PVC pipe made to fit 100 1-oz silver rounds. Tell me youre a survivalist without telling me youre a survivalist. The backstory is that with gold and silver being pretty up these days, this guy decided to come in and sell some of departed dad’s stuff. When a guy packs his silver away like this you can sorta get the impression that he’s on the same page you are.

It was a PVC pipe made to fit 100 1-oz silver rounds. Tell me youre a survivalist without telling me youre a survivalist. The backstory is that with gold and silver being pretty up these days, this guy decided to come in and sell some of departed dad’s stuff. When a guy packs his silver away like this you can sorta get the impression that he’s on the same page you are.