I ran out of dish detergent yesterday night an thought “No big deal, I’ll trot downstairs and grab another jug of the stuff.” To my chagrin, that was the last one. Bad survivalist! Sure, the end of the world is not going to be made worse by a lack of dish soap, but it’s the principle of the thing: shoulda had it, didnt.

So, that got me to thinking that January (or, really, late December) should be my evaluation period for purchasing “a years supply” for the coming year. I’ve made a list of a few things I’m just going to go ‘heavy’ on and see if they do indeed last me the year. This should make for some interesting looks from the guys running the registers at CostCo when I pick up a dozen drums of detergent.

And as I said, the end of the world experience will not be greatly affected by a lack of dish soap. But a ‘localized’ end of the world..such as a job loss or similar, ‘personal’, disaster will be somewhat eased if I can reduce the number of things I have to buy until I”m back on my feet.

Think about it. Pretend you lost your job and its going to take you three months to get another paycheck coming into the household. Every dollar is going to count, right? So the less money you’re spending on toilet paper, paper towels, soap, food, clothes, etc, is more money you have to stretch for other necessities. This is why I try to keep as much long-term-storage-friendly consumables on hand as possible.

I have the storage space (mostly) to go deep on stuff like that, and even if the world doesn’t come to an end I’m still ahead, inflationwise. There is an opportunity cost, I suppose, to tying up that money when it could be doing other things. That brings up a much bigger quandary: cash or goods?

Let’s say I spend $100 on toilet paper to store for the year. Assuming inflation runs around 4%, that means it would take $104 to buy that same toilet paper at the end of the year. By buying it upfront, I ‘made’ 4% on my money. But what if I simply took the $100 and put it in an envelope in my desk? At the end of the year it only buys me $96 worth of toilet paper. BUT…it can also buy me a host of other goods, whereas if I had spent the $100 on TP all I’d have is TP. In other words, $100 worth of TP vs. $100 cash. $100 of TP is just TP…but $100 cash can become $100 of TP, food, fuel, ammo, shoes, etc. So, it might make more sense to store the cash, rather than the TP.

As I said, my buying power is reduced by inflation…Assume TP was $1 a roll, just for round numbers. $100 gets me 100 rolls in January, but in December it gets me 96. But if I invested that $100 at something that made more than 4%, that would mean I could buy at least 100 rolls in December. The stock market, yearly, returns upwards of 10% on average, right? So, in theory, I park $100 in January and in December I buy 110 rolls of TP.

But…risk, scarcity, and self-discipline come into play. The investments may go down and my $100 may get cut to $75. So..75 rolls of TP in December. Or scarcity may come into play..the TP crop could get TP weevils and the price shoots up. Now my $100 can only buy 50 rolls in December as the price doubled. Or inflation may go past 4%. And, finally, self-discipline – can I stare at $100 sitting on my desk for a year and not touch it? Mmmm…

And often the bird in the hand is worth the two in the bush, y’know?

So…goods. This isn’t to say I don’t keep money stored away. I just keep it where I can’t see it or get to it without a conscious, purposeful effort.

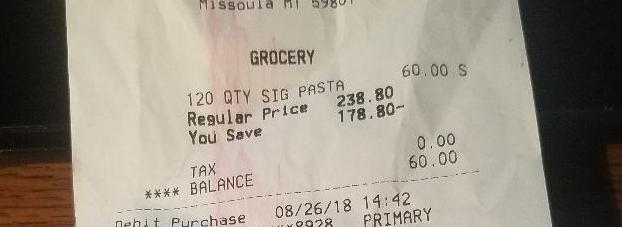

All this to say that next payday I’m going to pick one item off my list of ‘Go Heavy’ and stock up for the year. At the end of the year I’ll review if the amount purchased was indeed a years supply. That’ll give me a good metric of what a years supply constitutes around this house.

This mental exercise in frugality, preparedness, and cost/benefit has been brought to you buy writers block, an empty soap container, and un upcoming sense of dread.