I took the last two days off from work because I caught some bug (not Wuhan Flu) and didn’t want to wind up knocking out half the people at work by giving it to them. I very seldom take Paid Time Off (PTO) so I’ve accrued a hundred or so hours of PTO that I can use. And I accrue another five hours every pay period. SO…taking yesterday and today off.

One of the things I did with the time was update my personal finance stuff. I’ve been using the same budget and spending plan since 2017. Hey, if it works, it works. But I needed to clean it up and streamline it a bit to reflect that I earn a bit more money now than I did seven years ago.

Succinctly, I live on about 45% of my income. The rest is immediately whisked off to various little hides. 15% goes into retirement investing, %15 goes into savings, %10 goes into an emergency fund, 10% goes into land fund, and %5 goes into my HSA. I very much understand that this is quite a departure from how most people live. Because of the way I live, I have a pretty small amount of living expenses. I don’t have a house payment, car payment, student loan payment, credit card payment, kids, or anything like that. My property rental covers my property taxes and insurance. My actual out-of-pocket living expenses are about $675 a month. That 45% of my paycheck covers that nut pretty quickly and leaves me a bunch left over for pretty much whatever I want. I don’t have the latest and greatest, and I’m using a ten year old computer (mostly for sentimental reasons), but ‘keeping up with the Joneses’ was never a thing with me.

What’s interesting, though, is that I have learned (the hard way) what the expression ‘pay yourself first’ means. I know most of us here are old-timers who have made way, way too many trips around the sun but for the younger crowd who maybe never had someone explain it to them, now might be a good time.

When I was younger, I had always heard the expression ‘pay yourself first’ when it came to money. I had no idea what that meant. I just got my paycheck, doesn’t that mean I got paid? Pay myself what?

You are the main character in your life’s story. No one, and nothing, is more important than you. Ford financing, the electric company, Krogers, the local ISP, and the kid who mows your lawn are not more important than you. When you get your paycheck (or any other income…be it lottery winnings, a gift, or $20 found in your winter coat pocket) the first person on the list of ‘where does this money go’ is you. You pull out the money that is earmarked for your savings, your investment, your ‘just in case’. Once that money is pulled out and safely stowed, then everyone else gets paid. That’s it.

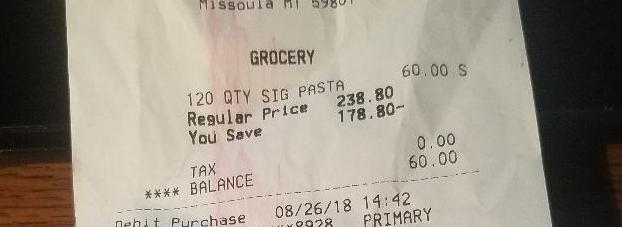

Why is it so important? Because, as I have repeatedly hammered into the blogosphere, you will need $50 bills far more often in life than you will need .50 BMG. You will have job losses, personal losses, medical issues, sick kids, bad transmissions, leaky water heaters, broken pipes, emergency travel needs, desperate loved ones, and a million other emergencies that will magically be downgraded to ‘inconveniences’ because you were able to just Write. A. Check.

It doesn’t matter how much you earn…calculate a dollar value or a percentage value and that’s the amount you take off the top, first thing, every time. Large amount or small amount, doesn’t matter as long as its something. To paraphrase Shepherd Book: “I don’t care how much you save, just save it.”

Ten years ago I made so little money it was ridiculous, and that lack of earning wound up costing me a lot . When my head cleared, I looked for a career path that would provide better for me, I worked my way though the necessary education, and now I do okay for myself. I’m not rich, and I still make less than many people, (but my net worth, on the other hand….) but at the end of the month I have money in the bank, a roof over my head, food in the fridge, hot water in the pipes, and the security of knowing I have the financial resources to cover emergencies.

Part of preparedness includes being prepared in case the world doesn’t end. That starts with paying yourself first.