Do you know what the current national debt is? It’s around $35 trillion dollars. A trillion dollars is a big number so let me give you a way to relate: if you took $35 trillion dollars in $1 bills and laid them end to end they would reach to the sun and back….eighteen times*.

You know that enormous loop around the sun that this planet makes in twelve months? Those dollar bills, end to end, would cover that orbit…almost six times.

Want more to relate to? If you took all the US currency thats out there right now it would add up to…..around $2 billion dollars. Put another way, we owe, as a nation, around 17,500 times more money than actually physically exists.

Let’s keep rolling. The US population is around 330,000,000 people. Your share of that national debt is about $106,000,

Wanna seize all the privately owned land and use it to pay the debt down? Good luck with that…that won’t even cover half the debt since all the privately held land in the US is only worth about $14.488 trillion dollars.

What does a high national debt mean? People are less likely to lend to you if youre already maxed out on your cards. Who is going to lend you money when all your available cash is going to pay back previous lenders? So..you gotta sweeten the deal…and thats where those 30% interest rates on predatory credit cards come in. Now imagine that on a national level.

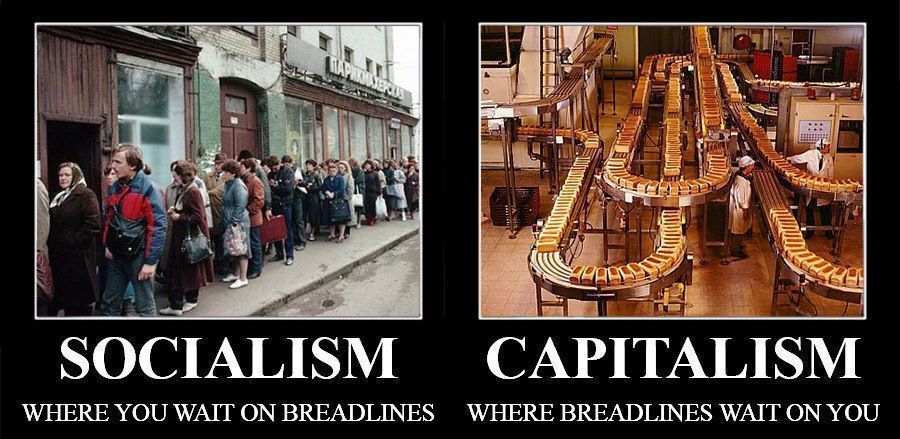

So..you’ve maxed out your credit cards to the point where you owe 17,500 times more money than you have in the bank. How do you get out of this mess? Well, you can try to pay it back but you literally will not live long enough to do so even if you lived several lifetimes. You can file for bankruptcy. Or you can shrug and just keep spending knowing that it is impossible to pay off the debt so you may as well go full kamikaze and spend like there’s no tomorrow.

Whats it look like if the US did that? Well, we coulud simply refuse to pay Japan and China, our two biggest creditors, and we’d probably be in an economic cold war with them for the next forseeable future. Or, we could renegotiate the deal which just kicks the can down the road and makes it more expensive later. We could just print the money, physically or electronically, to pay it off thereby devaluing our currency.

(/:Zimbabwe has entered the chat)

(/:Weimar Republic has entered the chat)

Or, more likely, we will just pay lip service to debt reduction and continue to spend because apparently austerity measures and budget cuts just aint gonna happen. And at some point there is only going to be two choices: monetization or renunciation. Either one spells economic chaos on a global level.

On the other hand, we surpassed the level at which debt couuld be mitigated a long time ago and we are still here, still borrowing, still being loaned to, and still spending without cutting…although at this point cutting anything will have a virtually zero effect on things.

I bring this all up because I was curious about where the national debt was today and fell down a math rabbit hole. But, honestly, I’m hoping I’m simply being naive, unlearned, and grossly ignorant about economics, because everything I just wrote pretty much concerns me greatly.

For a literary treatment about a US renunciation of the debt and the apocalypse that follows, I highly recommend this book.

To the sun and back, eighteen times……geez.

* = Math: one dollar is 6.14 inches long. 35t of them is 214,900,000,000,000 inches. That is the same as 17,908,333,333,333.33 feet, or 3,391,729,797.97 miles. The distance to the sun is about 93,000,000 miles. 3,391,729,797.97 divided by 93,000,000 is 36.4. Since its a round trip we cut that in half = 18.2 times the length distance to the sun and back.