I was having a little exchange in email with someone and was describing how the direction of my own prepping (and I really hate that word..it sounds so cutesy and trendy) has changed as of late and why. Maybe it’s worth a post or two.

I’m fairly satisfied with where I’m sitting in terms of food, fuel, materiel, etc, etc. It’s not necessarily gilding the lily to continue on the current path, but this current economic clime is one that makes me think now is the optimal time to shift directions for me.

As I mentioned earlier, we’re in a somewhat better-than-usual economic period. Jobs and markets are at record numbers. I’m not going to say that money is out there falling from the sky, but for someone with a brain, work ethic, and ambition, now might be a good time to work on getting the financial side of preparedness buffed up…take the extra job, invest the extra cash, sell the unused items, etc.

What does the financial side of preparedness look like? For the ‘casuals’ that may look like the classic six-month-emergency fund in the bank, pay off the credit cards, and beef up the Roth. For us lifestylers it may look like that plus cash in the safe, cash equivalents like gold and silver, trade goods, and other assets (like land).

I’m pretty sure I will be just fine if I don’t buy another gun, freezedried, or backpack for the next five years. And, as I’ve said over and over, the times in my life where I urgently needed money far outnumber the times in my life where I urgently needed a Barrett 82A1. Doesn’t mean that moment won’t happen, just saying that so far I’ve need $50 bills more than I’ve need .50 API.

Trying to avoid this

So, for the last few months I’ve cut back on my spending on things like storage food, ammo, guns (sorta), and the like, and have instead been moving more resources into savings, investments, cash, hard currency, and that sort of thing.

The economy is doing well at the moment but nothing lasts forever. If this good economy affords me the opportunity to get my ducks in a row for when it inevitably starts to decline…well, wouldn’t that be the smart thing to do?

So..for now, my focus is mostly on getting the money stuff squared away. If the zombies/war/Depression/invasion/flu/volcano/collapse occurs tomorrow I think I’ll be just fine with what I have on hand…but I don’t share that same level of confidence if some of the more mundane life disasters (transmission, broken leg, water heater, job loss, unexpected critical expense, etc.) occur. This change in direction will hopefully change that.

As I read that last paragraph it seem that could be interpreted as the direction of the blog changing, rather than personal direction. Nope…the blog will continue to strive to mediocrity with no change in its usual aimless topical wanderings. But personally, yeah, I think I’m going to be working on the really, really unsexy parts of preparedness. But…it’s gotta be done.

Piggy Goals.

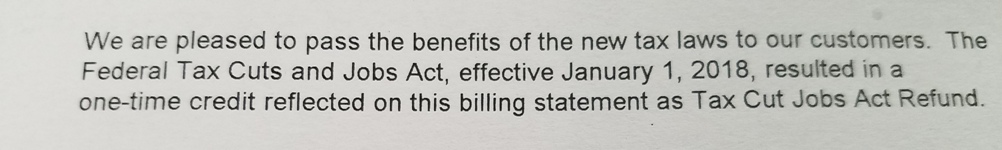

Hunh….well, that was cool. Never had that happen under Obama. Shaved $30 off this months bill. Still haven’t gotten my wall yet, though. I’d happily have traded that thirty bucks for a border wall. But…that FTCJA just paid for two Magpul happysticks, or three 17rd Magpul Glock mags, or five AR mags…Making America Geared Again.

Hunh….well, that was cool. Never had that happen under Obama. Shaved $30 off this months bill. Still haven’t gotten my wall yet, though. I’d happily have traded that thirty bucks for a border wall. But…that FTCJA just paid for two Magpul happysticks, or three 17rd Magpul Glock mags, or five AR mags…Making America Geared Again.