I’ve been noticing that silver has been in the (mostly) below $15 range for the last couple weeks. At one point it very briefly dipped below $14, which was pretty surprising. Problem is, you head down to your local metals dealer to by some you wind up at dang near $20/oz. because of the premiums. Whats up with that?

As I understand it, delivery times on physical silver (and, really, why would you own anything else) are pushed out pretty far. Want a ‘monster box’ (500 ct.) of Silver Eagles? Pay now and we’ll call you in a few weeks when it arrives. And that’s not just Eagles…pretty much all the nationally minted stuff is backed out, too. The generics aren’t much better. Sunshine makes the plancehttes for the US mint, so getting Sunshines is also an exercise in patience. So while the generics have a lower premium than the nationally minted stuff, you’re still looking at waits for anything in quantity.

It seems that the only thing that isn’t on backorder is ‘junk silver’…the pre-’65 coins. Which makes sense since there is no manufacturing bottleneck on those…they’re already made. I want to say the junk stuff was going for around 14-15x face value the other day…which means ten dollars worth of dimes, or ten dollars worth of quarters, will set you back $140-150.

I rather like Canadian Maples and Sunshine rounds for their anti-counterfeiting measures. The Maples are hard to get right now but I can usuualy find some Sunshine Buffaloes in the ‘generic bin’.

I’m not sure where the price of silver is going but I would say its almost certainly going to go up. The days of $6 silver are, I think, gone for a long time. I’d say $15 is about the new normal for this sort of thing. Of course that can change depending on how the markets go…when the markets get wonky people run for something that holds value a little better. And, of course, us ‘anti-government, survivalist’ types always feel a little better with our holdings diversified into tangibles….ammo, guns, fuel, silver, gold, cash, etc.

If you think you want some silver and don’t mind the wait (which really isn’t even a choice at the moment) go rattle the cage of the Metals Pimp.

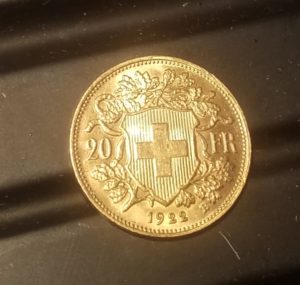

I have turned lead into gold. I am officially an alchemist. (Though not a FullMetal Alchemist.)

I have turned lead into gold. I am officially an alchemist. (Though not a FullMetal Alchemist.)