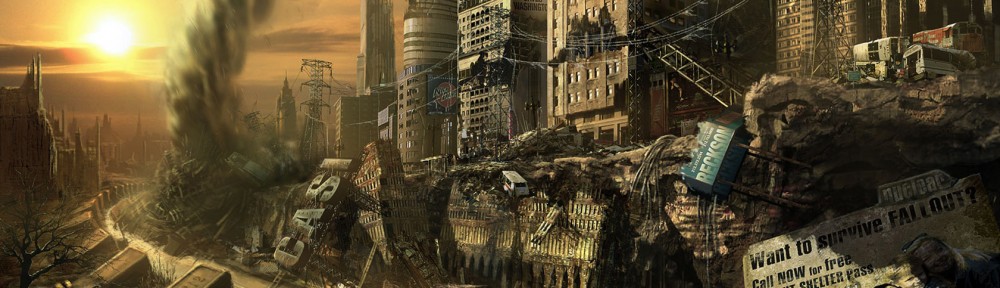

Kind of a question and answer all in one photo:

By the way, it’s surprisingly difficult to take a picture of gold. The lighting has to be just right or you get hellacious glare.

By the way, it’s surprisingly difficult to take a picture of gold. The lighting has to be just right or you get hellacious glare.

I really don’t believe there’ll be a time when we’re trading gold and silver in the burned-out rubble of WalMart for cans of out-of-date food. And I’m somewhat sure that a bout of Weimaresque hyperinflation isn’t coming. (Although history has shown that a world war does wonders for economies…maybe we’ve got something coming up against the Russians/Chinese.) And it isn’t really a great investment since it’s returns are lowest among pretty much any investment. (And, yes, gold really isn’t an investment as much as it is a store of wealth. There’s a big difference there.)

But, for some reason, it makes me feel better having it. Like the shelves full of #10 cans of freezedried food, the cases of AR’s, the rack of full fuel cans, etc. It just makes me feel calmer, even though I intellectually know that my odds of needing them are rather slim. But…that could just be the normalcy bias talking.

But, as I said, it makes me feel safer and calm……Which, I suppose, is all the justification I need for what I do.

Anyway, a portion of whatever I have available after the bills are paid goes to metals, some to investments, some to cash, etc. I picked these little generic 1/10ths the other day and they’re just too pretty not to take a picture of.

Agreed, its all about diversification. That stupid .40cal pistol you never got around to getting rid of was easy to shoot on cheap and plentiful ammo months after 9mm and .45 dried up at the start of the latest ammo crunch…diversification.

I have a little gold and silver but it is a TERRIBLE investment. Imagine how many 10’s or 100’s of thousands of dollars in profit you would be out over the last 10 years alone if you had been buying gold instead of putting most of what you had in the stock market.

Hmmm…..while I think of PMs as ‘insurance’ rather than investment, my silver is up 300% in 11 years. Not stellar, but not bad, either.

I have some General Motors stock at a fantastic price for you,it can never go bankrupt-world’s largest car maker.

I haven’t seen many 1/10 or 1/4 gold pieces available recently, and when I have seen them, their premiums were sky high (40% or more).

I prefer small pieces, but bought some larger ones recently since I got major mints with a reasonable premium that way.

Did you get these from your local dealer or somewhere on line?

I know some people in the business, and they like to shoot, so every so often it becomes a favor for a favor for a favor……

Glad to see you also have some foreign currency in your portfolio!! lol

Never know when you have to leave quickly!!!!

If we use the current example of Venezuela for crashing economies an ounce of silver will buy a lot of food and one of gold can buy a house.

https://www.reddit.com/r/Silverbugs/comments/cotgfn/the_rumors_are_true_1_toz_of_silver_in_venezuela/

Any *one* of those coins is worth at least 200 quadrillion zimbabwe-bucks.

Yeah,, I did that math too.

Precious metals:

– They occupy a spot between ones normal emergency credit card/ wad of cash/ savings account and Gremlins style canned food n shotguns.

– Your point that they aren’t an investment so much as a store of value is big. People certainly do trade them like any other commodity but ETFs are probably best for that.

-Physical metals are for (as noted above) situations where the economy is fucked but thing are going along otherwise. When you are not putting up punji stakes on the lawn but the savings accounts value is dropping fast.

Jinx!

Get out of my head.

http://raconteurreport.blogspot.com/2021/05/its-worse-than-you-thought.html

Happy that FL counties can only raise property taxes by 2.5% per year as per law…… our insurance rates suck though…..

Texas just passed constitutional carry,when can it get forced through in Fl?