Guns are a big part of my life… they make me money, they keep me safe, they encourage a particular set of values and lifestyle….but sometimes it gets difficult to remember that there are other aspects of preparedness that may actually be more paramount.

Between the Wuhan Flu, the repercussions of that flu on the economy, the ‘reset’ that we are seeing as jobs that were formerly secure suddenly become insecure, and of course the economic uncertainty of the upcoming administration, it is not unreasonable to think that perhaps stocking greenbacks may be a bit more prudent than stocking green tip.

There is, literally, no such thing as a secure job. Even if you work for yourself, own the building, and have no competition, you’re job is not secure. Literally anything can happen…..crazy legislation, an earthquake, a divorce, a heart attack, a fire, a war…..there is no shortage of things, black swan and otherwise, that can yank your employment rug out from under you. Certainly, some jobs are more secure than others…but the notion that “oh, I’ll always have a job..there’s always a need for [occupation] so I’ll always be employed” doesn’t take into account those curve balls. There’s always going to be a need for paramedics…so your job is secure. Right up until you get in an accident and lose a leg or your sight. The point is, while you can have a certain amount of security at your job you never, ever, ever have 100% security. So…be ready.

I spent a huge(!) amount of money on materiel in 2020 and, for the most part, I’m done. Oh, if a nice AR crosses my path for a bargain price, or a case of .223 turns up at pre-flu prices I’ll take it. But now it’s time to start resources into improving resiliency. And nothing improves your resiliency in the pre-apocalypse like cash.

My record of forecasting the future has been less-than-great. But…I foresee economic turmoil ahead. I see higher unemployment as flu-related impacts to business cause layoffs. I see jobs going away and not coming back (at least, not in the way they used to be). I see higher taxes on the folks who still have jobs. And I don’t see that changing in the near-term. Oh sure, there’ll be an bit of an economic bounce when we declare victory in The War On Chinese Flu but it’ll be a short-lived bounce.

If someone asked me what to do to increase resilience for 2021 I’d say “Wargame a scenario where you lose your job and can’t find another one at all or at the same wage and prepare for that”. That means clear debts as quick as you can, and start holding cash. Sure, you’ll lose some to inflation but I don’t see a Wewimar-esque hyperinflation coming yet. If you want to hedge your bets, split it among cash and metals. Here’s what I wold not do: I would not buy big ticket items just because I can, I would not buy anything on credit, I would not plan any expensive vacations, and I would not plan on having kids (because do you really want to take the hit of three months without a paycheck and have the added medical expenses and the additional stresses all at a time when things are so uncertain?)

When you come home, shoulders slumped and your mind racing, wondering how youre going to meet the mortgage now that your boss has said that your job is over in two weeks, will that new 4k television you bought last week seem like a good idea or would you rather have had that money in our account right then?

So, for me, it’s time to quietly make sure the decks are clear and start gathering up all the resources I can. I’m fortunate in that my house is paid off, and I used some of the windfall from gun sales to pay all the taxes for the next year. In a worst case scenario all I have to pay for is utilities and food. Right now money that would otherwise go to things like mortgage payments is freed up to go elsewhere. I suspect 2021 will be similar to 2020 in many ways, but I think it’ll also have some new torments to go with it. I want to be as resilient as I can be against that future. That means checking off the gun stuff from my list and moving on to beefing up the financial resilience. Might want to examine your own situation and see how youd fare if you got that pink slip tomorrow.

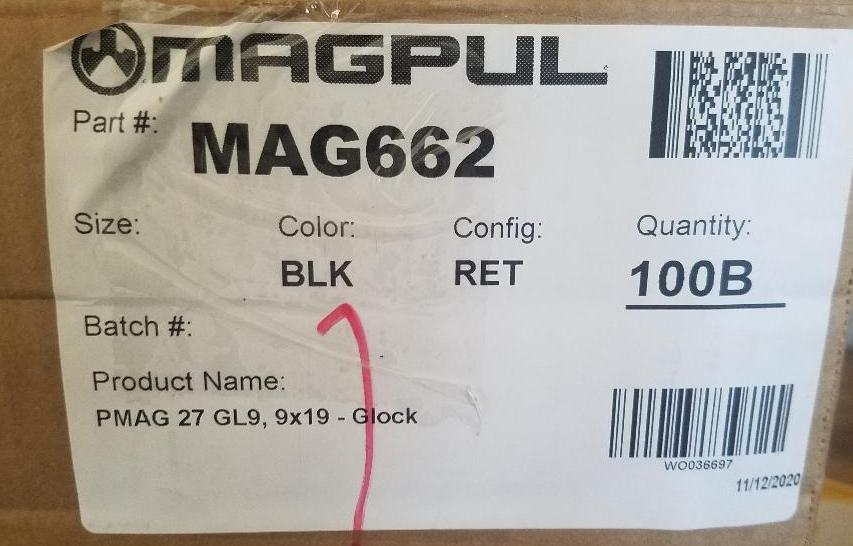

Under a Biden $200-tax-stamp-on-magazines program, you’re looking at $40,000 worth of tax stamp. I mean…you know…if a person actually registered them.

Under a Biden $200-tax-stamp-on-magazines program, you’re looking at $40,000 worth of tax stamp. I mean…you know…if a person actually registered them.